Time for my annual accounting where I try to create a single number that says something meaningful about how the farm did financially. This year, more than the past few, I feel like it’s obvious that numbers in accounting are malleable and really don’t tell the full story without a lot of context.

The single number I like to put out each year is the dollars generated by the farm, per hour worked, after (non-labor) expenses. You can look back at last year, and years before that, by going to the blog post on 2017 Numbers. Here are the basic numbers for 2018:

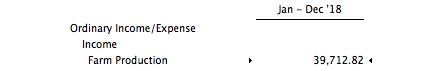

- Gross income – $39,712

- Non-labor expenses – $8,247

- Total hours worked – 1850

The basic math gives a net, pre-labor income of $31,465 for 1850 hours worked, which works out to $17.01 per hour.

That hourly number is before any payroll taxes, so if you’re trying to compare it to an actual hourly wage you need to lop off a chunk. Even so, we’re probably close to the $15/hr range, which feels pretty good, and actually gets us to the target minimum wage for this part of the country. Unfortunately, that still means that folks at the bottom of the pay scale are below that. We’re relatively flat in our pay structure and this year I was able to pay bonuses at the end of the season that made it even flatter.

These are very ball-park numbers even though they look exact. The gross income and hours worked are actually pretty exact, but it gets a little fuzzier when we look at expenses.

I’ve included some non-cash expenses in the expenses – essentially depreciation on equipment like the walk behind tractor and implements, and other structures. I’m pretty consistent about this in my own calculations, and it helps to even out the picture in years that have drastically different investment levels in tools and infrastructure. Beware that if you’re comparing to your numbers our methods might not match.

This year looks better than the past few and here are my best guesses on the reasons why. The primary reason is luck. A lot of things lined up for us this year: the weather was pretty good, we had great folks working with us who were available at the right times, and we were able to sell most of what we produced with very little waste. Certainly we set ourselves up to take advantage of those kinds of conditions, but even with experience (and partly because of experience) I know that there was an element of luck that certainly helped and we won’t have that every year.

Another factor that’s making the 2018 number look better than previous years is that we went really lean on expenses this year – something that probably isn’t sustainable. We weren’t sure if it was going to be our last year on the property (turns out it looks like we’ll get another year, maybe more) so we relied heavily on the tools, seeds and supplies we had on hand and didn’t have to spend much on non-labor expenses. I actually invested in a few tools for 2019 right at the end of the year but I didn’t put those expenses into the above numbers. If I had they would drive the non-labor expenses up by almost $2000. That changes the hourly number to $15.93. With luck, those investments in tools will improve our efficiency enough to pay back at least a portion of that $2000, and they should probably also be depreciated as they will mostly all last numerous years.

A few final pieces of context here. You can go to cullyneighborhoodfarm.com to get a better sense of the scale and practices of the farm. We’re growing on a lot that’s just under an acre, with just over ½ an acre in production. We’re not pushing our production particularly hard relative to many compact farms. Nearly all of income comes from CSA shares, but do make a little on top of that from some mid-season farmers market sales, by selling extras straight from the farm.

I’d love to see this same basic analysis from other farms and I welcome ideas for improvements to my method.

One Reply to “2018 Numbers”

Comments are closed.